"I had a strong idea of the product we needed to build, but I was pleasantly surprised when the [Counterpart] team came back with even better ideas of how to reach our goals. With Counterpart, all the bases are always covered."

Web Administrator

The Hamilton County Auditor’s Office processes all government-related finances for its entire county—that includes property taxes on the thousands of homes in the region. For more than a decade, the County continued to enhance its PDF-driven legacy software system by incorporating data from multiple internal systems to address additional business needs. As time passed, the navigation became too complex and the technologies outdated. The County IT department needed to rebuild the system.

The team began to outline requirements that would bring the system up to date in development and design best practices. But as the scope grew larger and more complex, the team realized they needed to bring in a software partner to offer fresh expertise and faster, dedicated developers to help hit an acceptable deadline.

Because of the wide-reaching impact of the portal, it was crucial that our teams work very closely together to leverage each’s expertise. One of our most collaborative projects to date, the solution we architected was a complete rebuild and modernization of the organization’s complex database in a customer-centric portal.

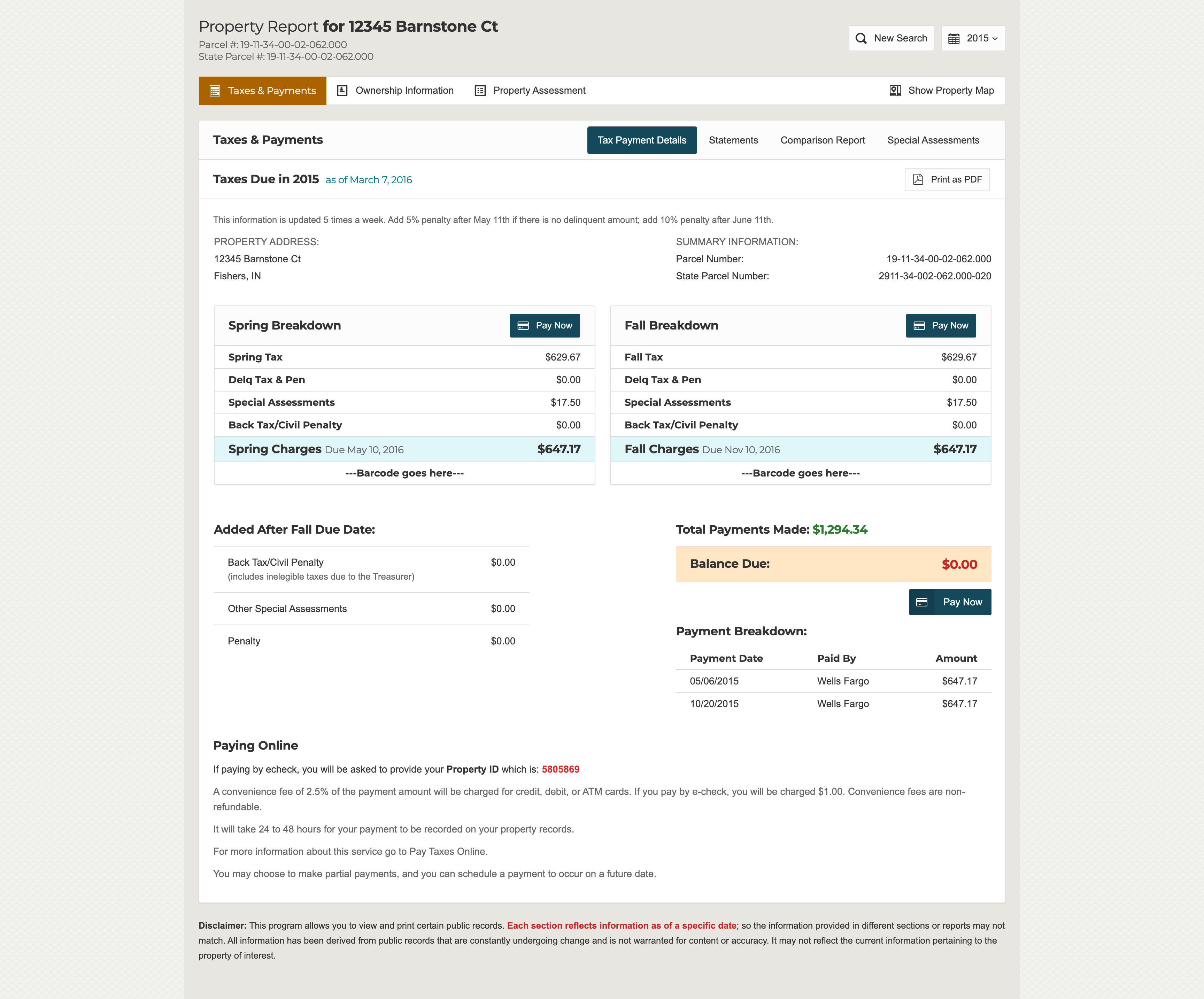

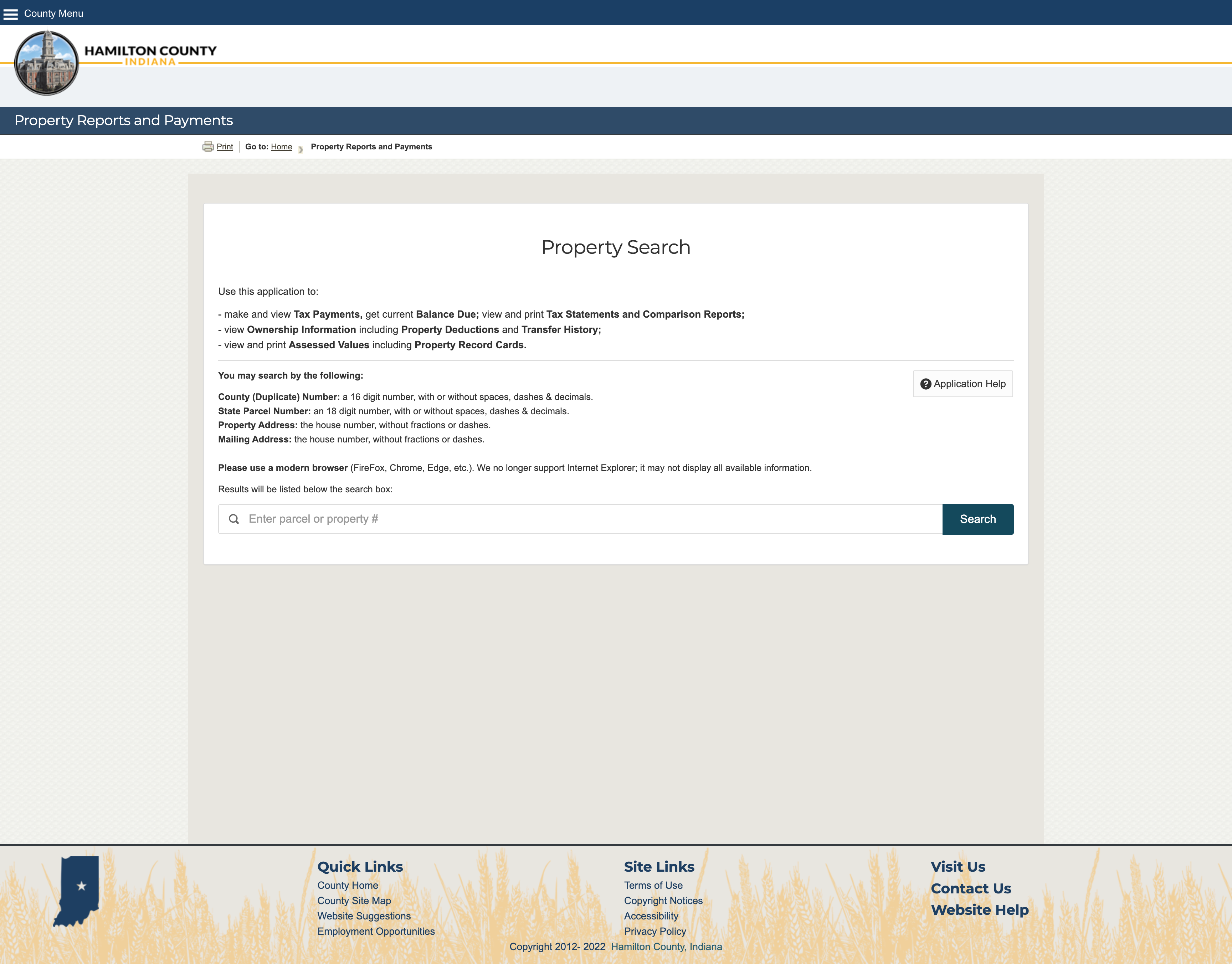

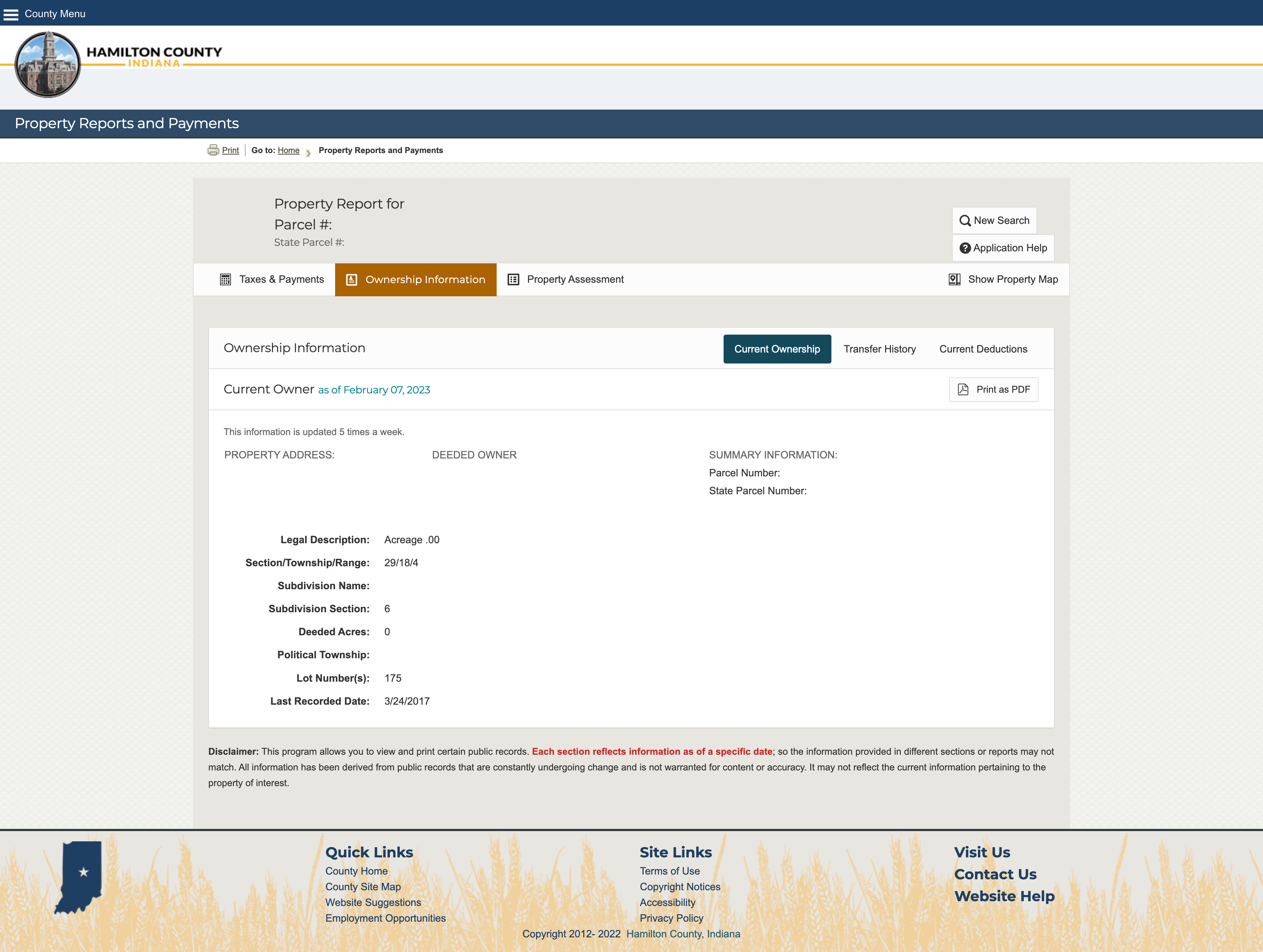

In the new portal, all information is now publicly available in a mobile-friendly, modern and streamlined interface. While the old system housed only a year’s worth of data per parcel (or property, essentially), the updated database holds up to three years of data, pulled from four different agencies—making a much more helpful tool for homeowners and others researching a parcel’s history, value and taxes.

The new portal brought this crucial tool a decade forward in technology, from UI/UX design best practices to the software programming itself, allowing individuals, mortgage companies and other property managers to view history, property values and taxes with ease.

Since the rebuild, we’ve also partnered with the Hamilton County team on other portal enhancements, including the submission of property deduction (exemption) forms—a process that was very mistake-prone, causing unacceptable delays. The new process provides an intuitive interface and leverages county data to auto-fill many of the form values. This not only makes for a less confusing experience for end users, but alleviates the Auditor’s staff from time spent on customer support and managing form corrections. In 2017, its first year of implementation, the digital exemption portal received 5,000 submissions.